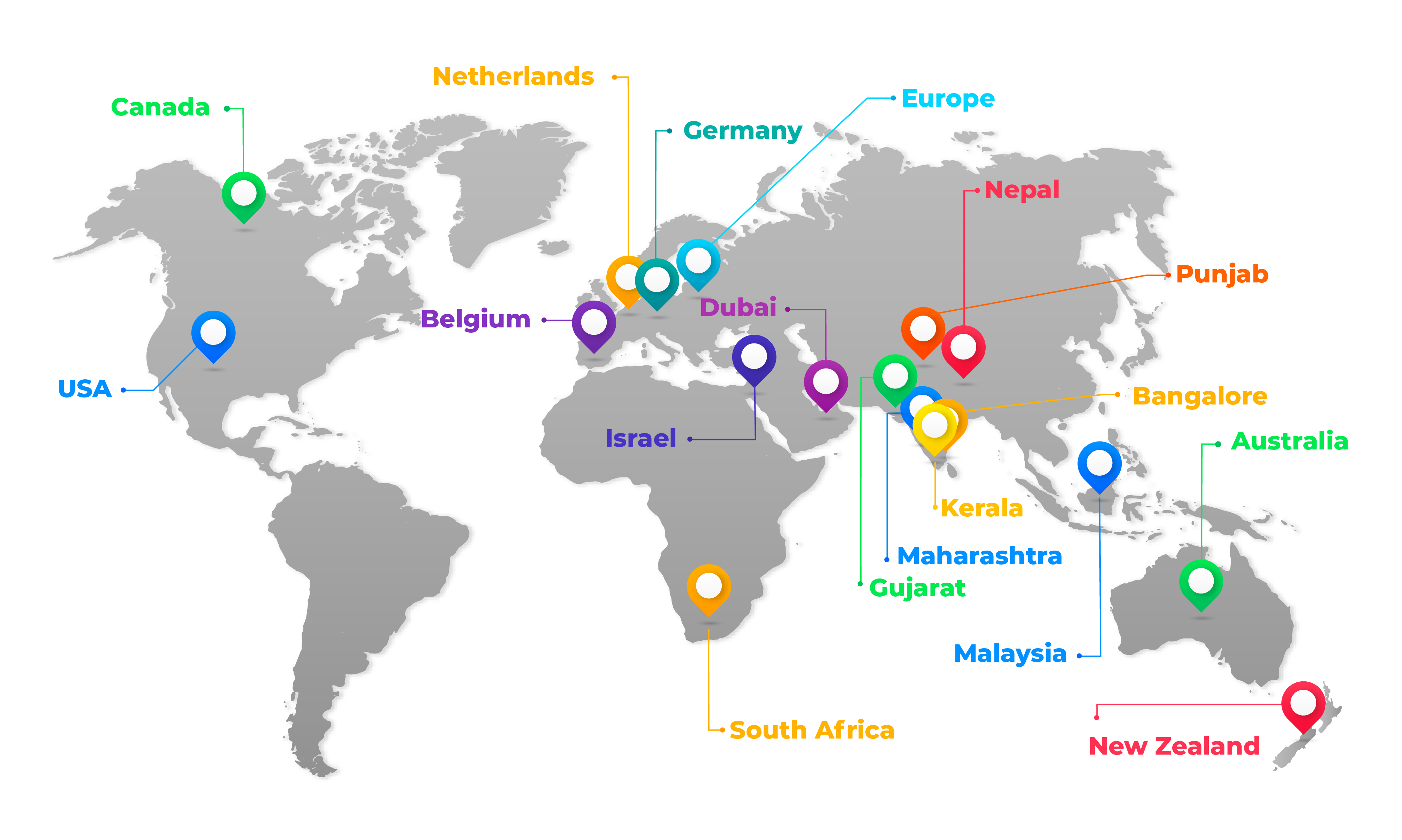

Located in the pristine foot hills of the Himalayas, nourished by the Ganges, Flex Foods is today one of the largest producers of natural food ingredients in the world. Flex Foods was conceptualized with a passion to provide quality ingredients to enthrall the palette of global consumers. For the last three decades, we have been delighting our customers with products, produced with great integrity and passion. That is the reason why many of the leading food companies and distributors of the world are our esteemed customers.

The journey of high quality ingredients starts from good farming. Flex Foods takes pride in the fact that most of our farmers are Global GAP certified. They undergo rigorous training on the latest farming technologies from our Agri Sourcing team. They are also constantly monitored and guided to produce good quality products. Above all, our farmers are hardworking, honest and passionate about what they do. All our products are processed at world class automated plants and are BRC AA certified. Furthermore, our employees have immense experience of processing of Agri products.

Copyright © 2020 Flex Foods Limited. All rights reserved